Letter Explaining Bad Credit to Lender

The advent of industrialization has fast-paced the world enormously. Everyday companies are showcasing new and sophisticated items and technologies. This has triggered a sort of rat race to get brand new stuff, although unwanted, and with less capital in people’s hands, more and more companies are lending money to people to expand their purchasing power.

The money is lent with predefined terms that need to be paid back in installments with or without markup. Many borrowers however fail to meet these terms and fall back on payments. In case such a situation arises, the lender (or an institution lending credit to the borrower) writes a letter of explanation asking the borrower to explain the reason for their failure to meet the terms and also to provide the necessary bank and financial proofs/statements. This enables the lender to chalk out a plan as to how to proceed with the remaining payments.

Letter of Explanation for Bad Credit.

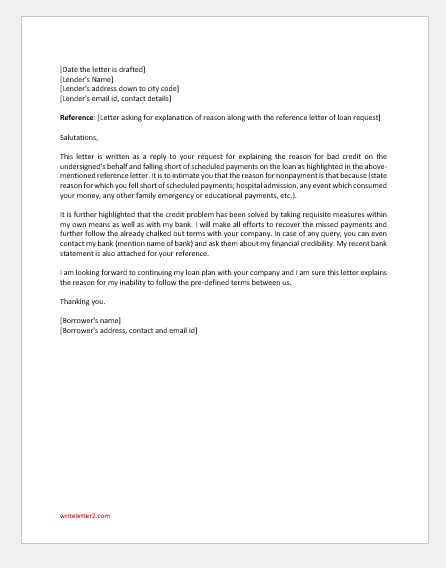

Simply put, a letter of explanation needs to be written by the borrower addressed to the lender and should incorporate the following details: –

- The date the letter is drafted.

- Lender’s information: name of person/institution, address, email id, contact number.

- Reference letter by the lending institution to which the reply is being given.

- The main body of the letter mainly explaining the reason for falling behind the scheduled payment plan.

- Any document that can be attached as proof for the reason mentioned above.

- Bank account details and other financial statements.

A sample letter of explanation is appended below. It has been written in a manner that the general structure of the letter can remain the same with specific details to be filled on a situational basis. These specific details are highlighted in red italics in the sample letter.

Sample Letter

[Date the letter is drafted]

[Lender’s Name]

[Lender’s address down to city code]

[Lender’s email id, contact details]

Reference: [Letter asking for explanation of reason along with the reference letter of loan request]

Salutations,

This letter is written as a reply to your request for explaining the reason for bad credit on the undersigned’s behalf and falling short of scheduled payments on the loan as highlighted in the above-mentioned reference letter. It is to intimate you that the reason for nonpayment is that because (state reason for which you fell short of scheduled payments; hospital admission, any event which consumed your money, any other family emergency or educational payments, etc.).

It is further highlighted that the credit problem has been solved by taking requisite measures within my own means as well as with my bank. I will make all efforts to recover the missed payments and further follow the already chalked out terms with your company. In case of any query, you can even contact my bank {mention name of bank} and ask them about my financial credibility. My recent bank statement is also attached for your reference.

I am looking forward to continuing my loan plan with your company and I am sure this letter explains the reason for my inability to follow the pre-defined terms between us.

Thanking you.

[Borrower’s name]

[Borrower’s address, contact, and email id]

Size: 19 KB Word .doc File 2003 & later

Download